From magnetic mid-drives to automatic shifting hubs, China Cycle showcased the next wave of e-bike innovation.

I didn’t know exactly what to expect walking into China Cycle 2025.

It was my first time attending the show, and while I’d heard it was large, I wasn’t prepared for just how massive—and impressive—it would be.

Thirteen exhibition halls, over 1,600 booths, and a constant buzz of activity from both industry insiders and local Chinese cycling enthusiasts set the tone. But what really caught me off guard was the sheer level of e-bike innovation on display.

I saw hub motors with integrated automatic shifting, magnetic mid-drive systems claiming higher torque and quieter performance than today’s leading systems, and folding bikes with unconventional frame designs engineered for increased rigidity.

Chinese motor manufacturers are not just catching up—they’re starting to challenge and even surpass long-established brands like Bosch and Shimano. Large-scale OEMs, who quietly build bikes for some of the biggest names in the industry, were front and center, proudly showcasing the scale and precision of their manufacturing capabilities.

I walked in curious—maybe even a little skeptical—but I left convinced: China Cycle isn’t just growing, it’s becoming the industry trade show to attend if you are an e-bike enthusiast or brand.

A Trade Show on a Whole Different Scale

China Cycle 2025 was big in every sense of the word. Spanning 13 exhibition halls and covering more than 160,000 square meters, the show featured over 1,600 booths. What stood out wasn’t just the size, but the level of production and energy throughout the event. Booths were elaborate—on par with what I’ve seen at CES—and the crowd was massive. While there were plenty of global brands and industry insiders, a large portion of the attendees were everyday Chinese consumers. That alone says something important: cycling, particularly road cycling, is growing fast in China, and with a population of 1.4 billion, that means there is a lot of growth opportunity for cycling brands to grow locally.

Hidden Giants and Innovators: The Brands Powering Global Bike Production

One of the most eye-opening aspects of the show was just how many massive OEMs operate behind the scenes of the global bike industry. Companies like Phoenix and Fujita may not be household names in the U.S., but they’re responsible for producing bikes for some of the biggest brands on the market.

Phoenix, for example, builds bikes for Walmart. Fujita manufactures bikes for a few of the largest bike brands in the U.S., and also produces the Battle brand in China.

And then there’s Dahon—the world’s largest folding bike manufacturer. Dahon put on a standout competition during the show, offering a $5,000 prize to the rider who could produce the most power on one of their folding bikes. Their bikes use a unique cable-tensioned downtube instead of a solid frame piece, reducing weight while increasing rigidity.

These companies aren’t just producing bikes—they’re innovating, competing, and redefining expectations.

Motor Power Shifts: Chinese Brands Step into the Spotlight

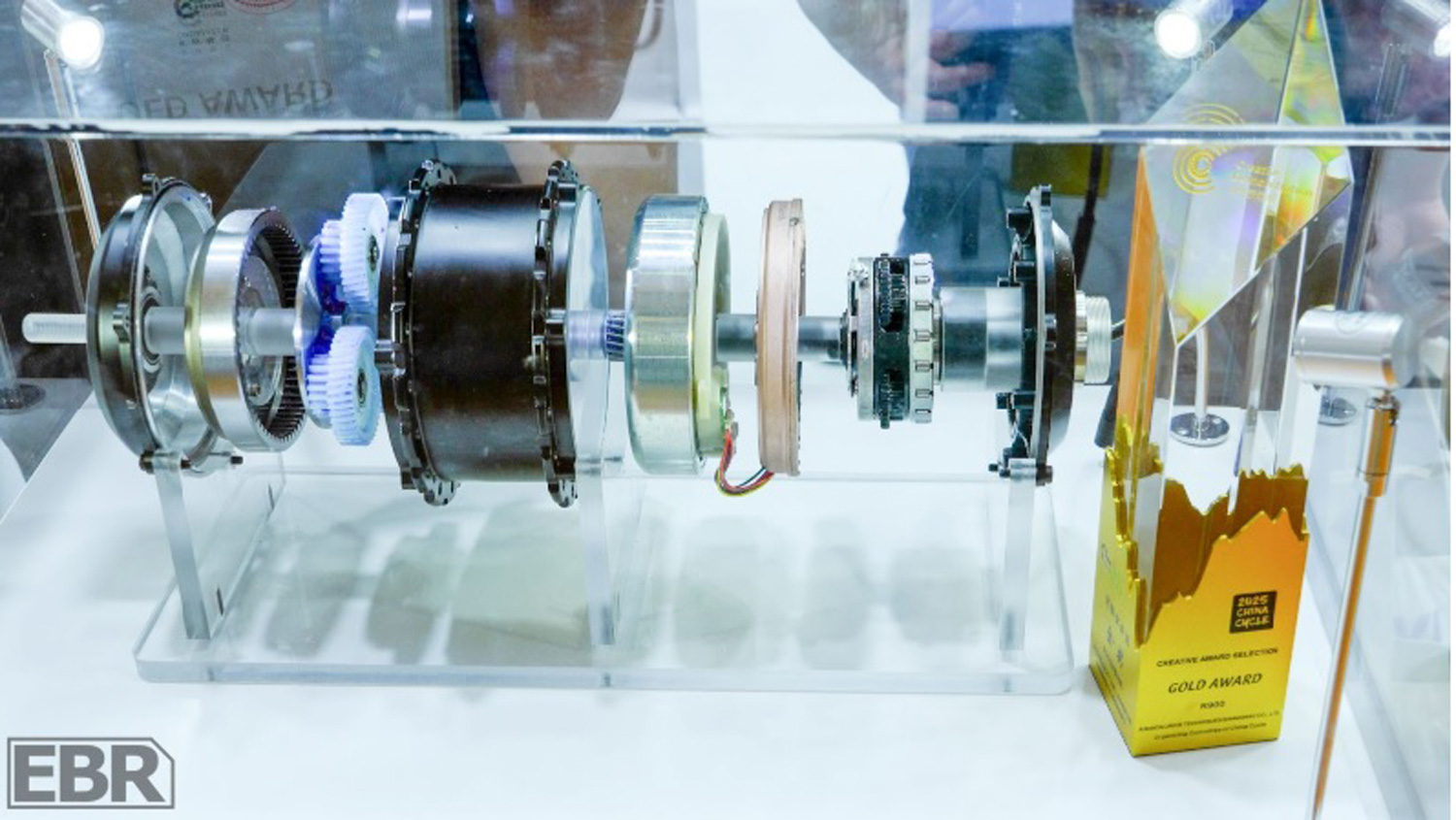

Ananda’s award winning R900, a 3-speed electronically controlled shifting hub motor

Motor manufacturers in China are no longer just playing catch-up—they’re starting to push ahead. Some of the most impressive developments I saw at China Cycle were from companies like Bafang, Ananda, Motinova, and Star Union.

Bafang showcased its H730 automatic hub motor, which integrates shifting directly into the motor housing. The H730 is a 250W, 40Nm torque motor designed mostly for the European market and commuter and city e-bikes.

Ananda took home an award for its R900 system, a 3-speed electronically controlled shifting hub motor. The R900 has slightly 50Nm of torque, and they claim that the electronic shifting offers advantages over Bafang’s models, especially under load.

I rode both, and what stood out most was the smoothness. I typically don’t like automatic shifting—usually, it never shifts when I want it to. But both systems surprised me. They shifted intuitively and naturally, letting me focus on the ride.

Then there’s Star Union, whose lightweight magnetic gear mid-drive (MGM) motor is one of the most promising systems I’ve seen. It’s quieter than the TQ HPR-50 and delivers 80 Nm of torque, with talk that future versions may reach 90–95 Nm—all without increasing size or weight. I rode an eMTB equipped with the MGM mid-drive, and while I didn’t have access to trails or big climbs, the motor was noticeably quiet and felt powerful. For a motor this light, the performance was impressive. If Star Union can bring torque up to 95 Nm, they’ll be in a position to compete directly with heavier full-power systems—especially appealing for riders looking to keep weight down without sacrificing climbing ability. The MGM system also shows great promise for use in gravel, road, and other lightweight, high-performance e-bikes where weight, efficiency, and ride feel are critical.

Motinova also deserves attention. Owned by the Midea Group—a Global Fortune 500 company with over $50 billion in annual revenue—Motinova is bringing advanced engineering and manufacturing strength to the e-bike space. One standout feature in their motor design is the use of square copper wiring, which is harder to produce but offers more space-efficient coil windings. They’re also strategically positioned with manufacturing capabilities in Vietnam, giving them an advantage when navigating tariffs and expanding globally.

Across the board, these brands are showing that Chinese e-bike motor makers aren’t just catching up—they’re starting to compete head-on with other industry heavyweights. And when you ride the bikes, the innovation is something you can actually feel.

From New Zealand with Muscle: Velduro Phantom

Not everything that caught my attention came solely from China. One standout product came from Velduro, a New Zealand-based brand introducing a new electric gravel bike called the Phantom.

The Velduro Phantom was possibly my personal favorite from the show, and we can’t wait to get one in to test.

The Phantom is powered by the DJI motor, which puts out 120 Nm of torque and up to 1000 watts of peak power—all in an impressively light and smooth-feeling package. I got a chance to take it out on the test track, and the motor delivered in every way: powerful, quiet, and extremely natural to pedal. It was one of the most fun rides I had all week and is the best e-gravel bike I have ridden.

Velduro is offering the bike in three tiers: a $5,990 NZD ($3,500’ish USD) frame-only option, a flat-bar build with alloy rims and Shimano Cues 11 speed drivetrain for $7,790 NZD ($4,650 USD) and a fully-spec’d version with carbon rims, AXS transmission, and a classic drop bar at $12,900 AZD ($7,600 USD). They’re also working on an eMTB using the same DJI motor platform, which I’m looking forward to testing later this year.

The Rogue eMTB from Velduro is still in testing phase, and are targeting production models to land in New Zealand in November.

Strategic Calm in a Trade War

Ananda is one of the companies who will likely benefit from production flowing from China to other Asian countries, as they have facilities in China, Vietnam, and Hungry

One of the more subtle but significant trends I noticed at the show was how Chinese manufacturers are responding to the ongoing U.S.-China trade tensions. With additional tariffs on Chinese-made e-bikes and components sitting at 145% (the Administration had not yet agreed to the temporary additional 30% tariff rate), I expected frustration, defensiveness, and anger.

Instead, the response was calm, calculated, and strategic.

Most of the major manufacturers I spoke with are actively looking to expand outside of China. Vietnam and Cambodia were frequently mentioned, as was Hungary in Europe. These aren’t just ideas—they’re in-progress moves designed to stabilize operations and avoid overreliance on any single country.

It’s clear that many Chinese brands are focusing more heavily on Europe and Asia for the time being. And who can blame them? Trade instability makes the U.S. a more difficult partner right now.

From my perspective, the tariffs aren’t accomplishing much. They’re not bringing manufacturing back to the U.S.—no one I talked to is even considering that. What they are doing is raising prices for U.S. consumers and incentivizing Chinese companies to move production overseas while maintaining control of the supply chain. If the goal was to diversify global manufacturing, that’s happening—but it’s Chinese companies doing the diversifying.

Worse, the trust damage between the U.S. and international partners may take years to repair.

Final Thoughts: Why China Cycle Matters

China Cycle 2025 exceeded every expectation I had. It wasn’t just the biggest trade show I’ve been to—it was the most forward-looking. The level of innovation, especially in e-bike motors and manufacturing, was undeniable. The show made one thing clear: the future of the e-bike industry is being shaped in Asia—and in some cases, by companies that most American riders have never heard of.

If you’re a brand, a retailer, a media outlet, or even just an enthusiast trying to stay ahead of the curve, China Cycle deserves a spot on your radar. This is where the next wave of breakthroughs is happening. And if what I saw this year is any indication, the rest of the industry would do well to start paying much closer attention.

Leave a Reply